Story highlights

Trump University put a book out on tax strategies

Donald Trump wrote the forward to the book

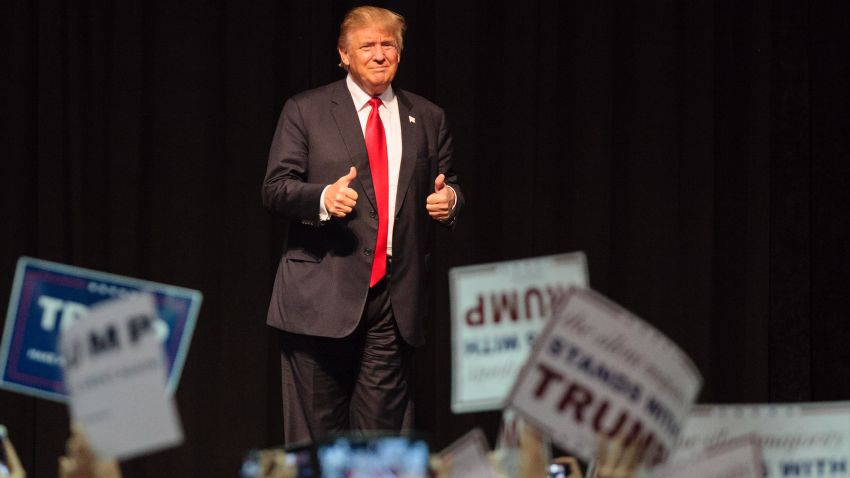

Donald Trump’s opponents have posited no shortage of theories for why the New York billionaire would be wary of releasing his tax returns. High on the list? The likely use of extensive tax avoidance strategies.

None other than Trump University – the now-defunct education company named after the tycoon – heartily touts a book explicitly designed to help people do just that: avoid taxes.

The book, “Asset Protection 101: Tax and Legal Strategies of the Rich,” lays out in extensive detail strategies to keep the U.S. government away from the readers’ assets. It minces no words on its intent, at one point telling readers “the topic of asset protection is amazing, cunning, baffling, powerful and tricky.”

READ: Trump University fraud case becomes campaign issue at GOP debate

Trump wrote the foreward to the book, which was authored by attorney J.J. Childers and published in 2007 under the Trump University banner – part of a series of books promoted as “practical, straightforward primers on the basics of doing business the Trump way – successfully.”

“If you’re not satisfied with the status quo in your career, read this book, pick one key idea and implement it. I guarantee it will make you money,” the presumptive Republican nominee wrote in his foreword.

RELATED: How to avoid paying taxes: Top 10 list of Trump University-approved strategies

Trump touts the book – and the others in the Trump University series – as a recipe to riches, calling the contents “the most important and powerful ideas in business – the same concepts taught in the most respected MBA curricula and used by the most successful companies in the world, including The Trump Organization.”

“I created Trump University to give motivated businesspeople the skills required to achieve lasting success,” Trump wrote.

Asked about the book and Trump’s personal strategies on tax avoidance, Trump’s spokeswoman Hope Hicks pointed to Trump’s tax plan, which is posted on the campaign’s website. As to Trump’s returns themselves, Hicks reiterated that Trump “is undergoing a routine audit and plans to release the returns when the audit is complete.”

Trump’s own taxes

Up to this point in the presidential campaign, Trump has declined to release his tax returns on account of an ongoing IRS audit – one that spans from 2009 onward, according to Trump’s attorneys. He has said he will release his returns upon completion of the audit, though he recently told ABC his tax rate “is none of your business.”

Trump has repeatedly said he would be willing to pay more in taxes and a central component to his tax proposal is simplifying the jumbled, unruly and loophole-filled tax code. When it comes to tax policy, Trump has said, his focus is tax relief for the middle class. Yet Trump has also made clear that as it currently stands, the real estate mogul seeks to find as many ways to legally avoid paying more taxes as possible.

READ: Trump on his tax rate: ‘None of your business’

“I mean, I pay as little as possible. I use every single thing in the book,” Trump told supporters in Iowa in January – a reference to loopholes that exist in tax code in general, not the Trump University book specifically. “And I have great people.”

He’s also made clear those strategies often play a role in the deals he pursues.

“It’s a factor,” Trump told the Wall Street Journal. “Sometimes, depending on what it is, it becomes an important factor. But taxes are always a factor for me and for everybody else.”

Tax strategies

The book itself is an in-the-weeds breakdown of strategies to shield income and property from the Internal Revenue Service. With sections including “Tax Secrets of the Wealthy,” “Lawsuit Protection Secrets of the Wealthy” and “Estate and Retirement Planning Secrets of the Wealth,” it’s composed of the ins-and-outs of how, in its words, readers can set themselves up to “pay as little tax as legally possible.”

In short, it’s a certified public accountant’s dream manual.

Of particular relevance to Trump is the chapter titled “The Greatest Tax Shelter in the World: Owning Your Own Business.”

READ: How Trump clarified his position on taxing the wealthy

It includes a section on breaks known as like-kind exchanges, or the use of “1031,” as it’s often called, for the section of the tax code where it resides. Use of such strategies is so valuable, it’s a shock they’re legal, according to one passage in the book: “Would you be interested in avoiding paying the tax on the sale of your property completely while maintaining or even increasing your overall net worth? Of course, any wise investor would. Amazingly, this can indeed happen and even better, it is totally legal.”

The break allows real estate owners to sell a piece of property and avoid taxes on any capital gains by buying a new one shortly thereafter. Continued use of the break, which basically comes down to swapping properties, would result in deferred capital gains that, if deployed strategically – and repeatedly – by an active real estate investor, could completely avoid taxation.

What’s unknown

As it currently stands, it’s unknown how much – or whether – Trump has utilized like-kind exchanges. Much of his wealth in recent years, Trump has said, has been derived from licensing the rights to his name, not from specific real estate transactions. But his real estate holdings are extensive, according to financial disclosures filed with the Federal Election Commission.

In that disclosure, which allows candidates to release their holdings in broad ranges, Trump lists his most valuable assets – classified only as worth “over $50 million” – as his real estate holdings.

Given that, according to Lily Batchelder, a professor at New York University School of Law, said it’s only logical that Trump would’ve sought to benefit from the break.

“I would definitely expect that he’s making use of 1031 for properties that he and his companies own,” said Batchelder, who formerly served as the chief tax counsel for the Senate Finance Committee. “It creates a big tax sheltering opportunity – and is particularly generous for real estate.”

Or, as the book puts it: “Rich people know how to take advantage of their tax situation. This is part of the reason they’re rich.”

But it’s not just a how-to manual. It’s also a marketing vehicle for one of Trump’s now shuttered educational businesses: Trump University.

At the conclusion of the book is an advertisement for a series of programs, books and even an immersive retreat. The closing message: “The road to wealth is a choice, but only if you take these steps.”

It then provides contact information for to enroll in Trump University courses.