Fear is creeping back onto Wall Street.

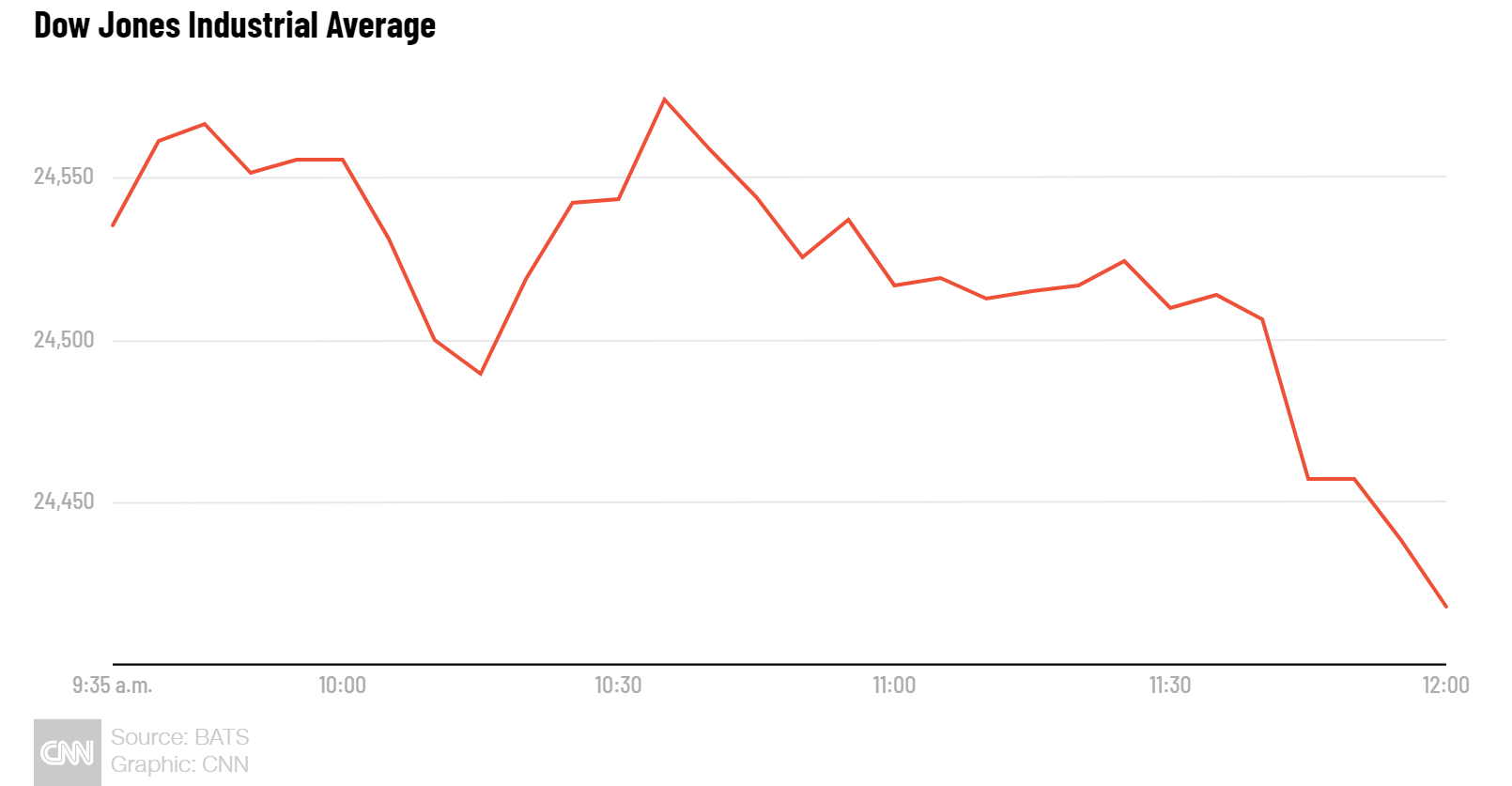

The Dow declined 302 points, or 1.2%, on Tuesday on renewed concerns about global growth and the US-China trade war. The S&P 500 lost 1.4%, while the Nasdaq tumbled 1.9%.

The selloff puts an end to a four-day winning streak on Wall Street. Worries about global growth were amplified by the IMF cutting its 2019 economic outlook, a weak US home sales report and new signs of trade tension between the United States and China.

Stocks bounced off their lows after Trump economic adviser Larry Kudlow denied that a planned trade meeting with China had been canceled.

Energy stocks (XLE) fell sharply on Tuesday, mirroring a 2.2% drop in US oil prices.

Stanley Black & Decker (SWK) plunged 15% after warning that 2019 earnings will badly miss expectations. Aluminum maker Arconic (ARNC) plummeted 16% are nixing a plan to sell the company.