US stocks finished virtually flat on Wednesday.

Equities got a boost earlier in the day, following comments from Treasury Secretary Steven Mnuchin that raised hopes for a resolution the US-China trade spat.

- The Dow closed flat in negative territory, down 9 points.

- The S&P 500 finished 0.1% lower.

- The Nasdaq Composite closed 0.3% higher.

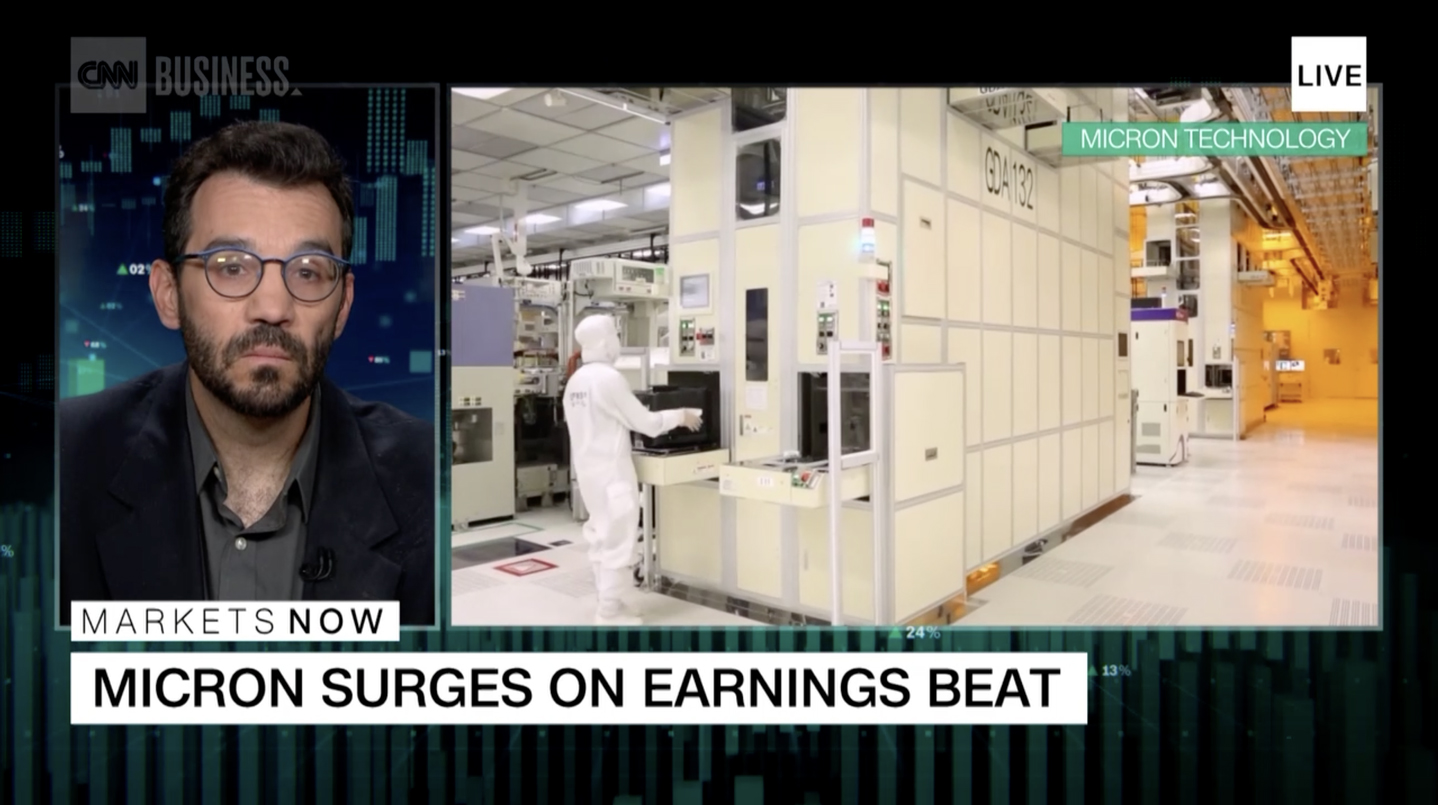

Tech stocks rose on the whole, following solid earnings from Micron (MU). Micron stock closed more than 13% higher. Intel (INTC) closed up nearly 3%, making it the top S&P gainer of the day.

General Mills (GIS) is the worst S&P stock, having fallen 4.5% after this morning’s earnings report.