Editor’s Note: Thomas Balcerski teaches history at Eastern Connecticut State University. He is the author of “Bosom Friends: The Intimate World of James Buchanan and William Rufus King” (Oxford University Press). The opinions expressed in this commentary are his own.

The recent battle between short-sellers and Reddit’s WallStreetBets crowd over the stocks of a handful of distressed companies has erupted into the global spotlight. Reminiscent of speculative bubbles of the past — “a modified pump and dump,” in “The Wolf of Wall Street” author Jordan Belfort’s words — the latest mania has been fueled by free online trading sites, such as Robinhood.

Though the particulars have changed, the GameStop stock surge is actually part of a longer history of attempts to manipulate markets, often with catastrophic results. Unless the Securities and Exchange Commission (SEC) regulates these efforts, such attempts will continue as speculative (and greedy) investors get more creative in the years ahead.

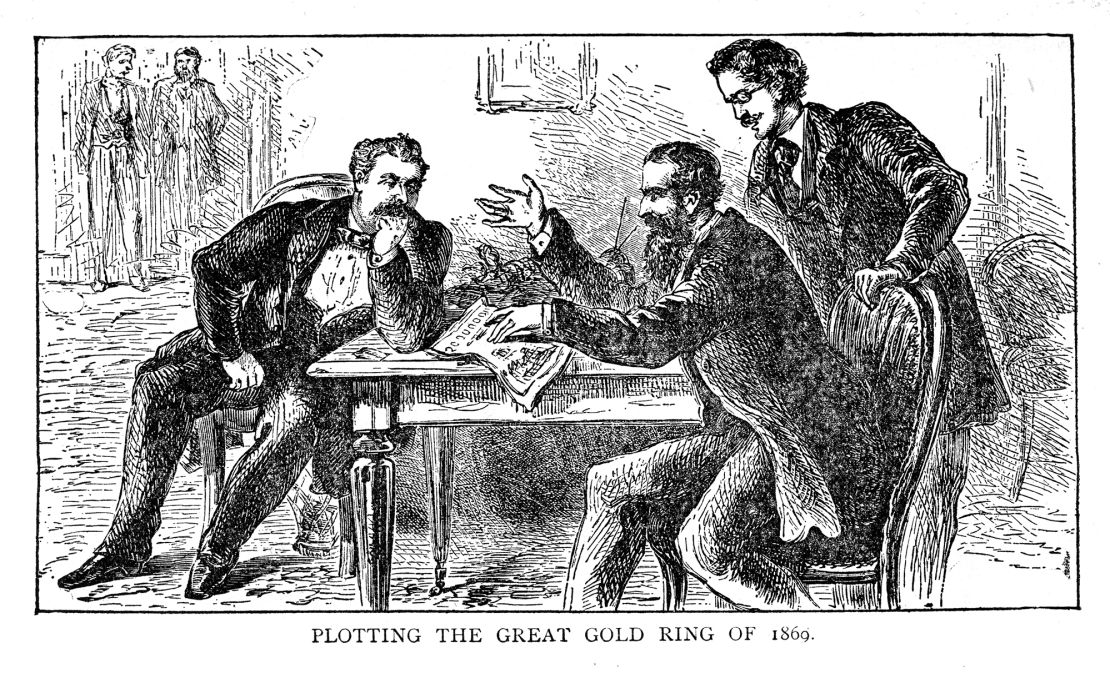

All we have to do is look back on September 24, 1869, when the nation suffered its first “Black Friday.” Gold prices were sent plunging after the US government uncovered a clever scheme by investors Jay Gould and James Fisk to corner the gold market.

Gould and Fisk were able to reveal a weakness in the way the US gold supply was being used to bolster the country’s financial system. They partnered with Abel Corbin, who was married to the sister of President Ulysses S. Grant and could secure them a meeting with the president. In that meeting, Gould and Fisk convinced President Grant that the government should avoid selling gold at all costs. As a result, Grant ordered the Treasury to temporarily suspend the sale of gold.

Gould and Fisk also persuaded Daniel Butterfield, the assistant treasurer of the United States, to warn them if the government began to sell gold again.

Seizing their opportunity, Gould and Fisk bought up as much gold as they could, effectively raising the price of the precious metal and, in turn, the value of their own gold supply. But President Grant found out about their scheme and ordered the Treasury to release an estimated $4 million worth of gold onto the market, which sent prices plunging.

The corner had been broken, though not without a panic ensuing on Wall Street. Investors scrambled to sell their gold holdings at the highest possible price, leading to a crash in gold prices and dragging down the US economy with it.

What unites this episode from the 19th century to today’s situation with GameStop? A small band of investors working in cooperation with one another were able to pressure — and continue to sway — markets because there were not sufficient regulations in place to stop them.

What’s worse: The history of Gould and Fisk’s corner on the gold market suggests that economic disruption will almost certainly follow attempts to manipulate markets. In the case of companies like GameStop that largely lack the fundamentals to support soaring stock prices, the bigger the bubble gets, the worse the impact will be on the very investors who rely on deep-discount trading platforms. The SEC warned last week that “extreme stock price volatility” has the potential to cause “rapid and severe losses” for investors and to undermine market confidence.

Senator Elizabeth Warren has called on the SEC to intervene to prevent further “potential market manipulation.” She wants the SEC to look into both Reddit users buying shares to boost the price and hedge funds shorting the stock.

But a major difference between the cornering of the gold market in 1869 and the GameStop bubble of 2021 turns on access. Gould and Fisk were part of the wealthy elite and had to worm their way to the highest person in government office to gain insider advantage. By contrast, the bar to entry is much lower today, and the average person can participate in these speculative manias — often for free — on discount brokerage sites.

That anyone can now have the power to manipulate markets reveals the need for more targeted regulation of trading platforms and financial systems more generally. With potential for the GameStop bubble to cause a meltdown in markets, we should all be game for these changes.