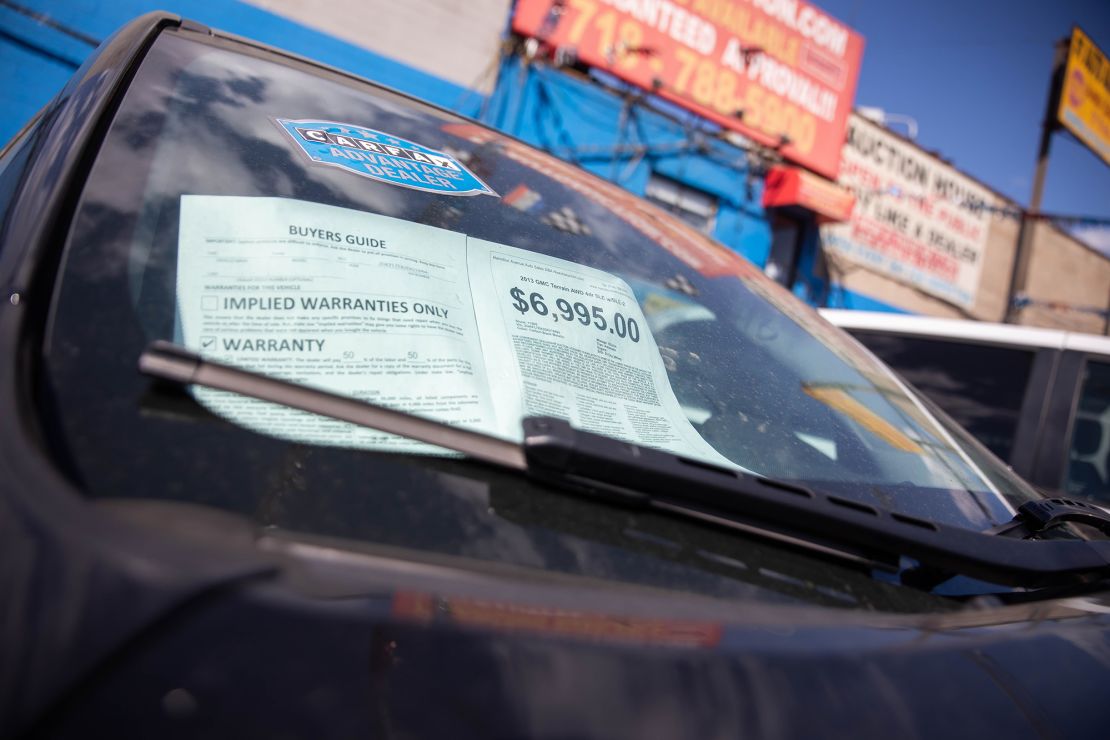

Car dealer lots have only a fraction of the vehicles — both new and used — that they typically have. That’s helping send prices to record levels and lifting the nation’s overall inflation rate.

And the price increases aren’t over yet.

The average new car price hit a record $38,255 in May, according to JD Power, up 12% from the same period a year ago.

About two-thirds of car buyers paid within 5% of the sticker price in May, with some even paying above sticker.

Wholesale prices for used cars sold at auction are up 39% since the start of this year, according to other data from JD Power. Retail used car prices are up a more modest 20% in the same period. That’s also a significant jump for this time of year, and the higher wholesale prices are pointing to bigger increases on the way.

“That puts wholesale used prices at the highest level they’ve ever been,” said David Paris of JD Power. “And we are seeing used retail prices accelerating rapidly.”

The US economic rebound has pushed consumer prices up at the fastest rate in nearly 13 years, and used car prices alone were responsible for a third of of the 5% overall jump in May.

It’s a 180-degree turnaround in the market from a year ago, when many car dealerships were closed by the pandemic or limited to providing service and maintenance. Massive job losses and a shift to working from home caused a 30% plunge in auto sales in the second quarter of 2020, the biggest quarterly decline since the Great Recession.

Now sales are booming, with May’s seasonally adjusted sales rate for new car sales to consumers rising 34% compared with a year ago, and up 10.6% compared with the more normal sales month of May of 2019.

Supply-chain woes

But resurgent demand is coming at a time when auto plants around the globe are closed or running at reduced production because of a computer chip shortage. New car production in North America was down about 3.4 million vehicles in the first three months of this year, according to Cox Automotive. And most automakers reported that the second quarter production was down even more than the first quarter.

The used car market is just as tight, with some measures of supply and demand in the sector showing the greatest scarcity on record.

Those two factors — strong sales and limited supply — are feeding the price boom.

“It’s a perfect storm,” said Charlie Chesbrough, senior economist for Cox Automotive. “If you’re not willing to pay near sticker price, there’s someone behind you who is. These issues will likely be with us through at least the rest of this year.”

Here’s a look at the major factors leading to the price surge:

Limited supply

The computer chip shortage is only one factor squeezing the inventory of available vehicles. Other auto parts, including tires and resins, are starting to be in short supply, experts say.

The limit on new car availability is being felt in the used car market. Rental car companies, which sold off about a third of their fleets last year in order to raise cash and survive the downturn, now have their own car shortage just as travel is rebounding.

The chip shortage also means that automakers don’t have an excess supply of new cars they can sell to rental companies at a discount.

“The [rental car companies] typically buy 2 million vehicles a year, and that’s how many cars they typically sell into the market,” said Ivan Drury, senior manager of insights for Edmunds.com. “With the automakers not able to sell to them right now, that turnover of one- and two-year old vehicles just isn’t happening right now.”

People returning to work

As offices reopen, workers who’d been staying home are beginning to resume their commutes, further fueling demand for cars.

Employers added 559,000 jobs in May, but that’s only part of the story. Other employers are notifying workers that offices that have been closed since last year will be reopening in the coming months.

Many who delayed new car purchases because of job uncertainty or the lack of a commute are now looking to buy. And some of those who took public transit to and from work may now want their own car to limit their potential exposure to Covid-19.

“People who are concerned about public transit and Uber are a factor in the growing interest,” said Nick Woolard, director of industry analytics for TrueCar.

More cash on hand, low interest rates

Many workers lost jobs and faced economic setbacks during the last year. But those who kept their jobs may have more available cash than normal. By some estimates, Americans have an extra $2.4 trillion in savings compared with a year ago.

Spending on activities like vacations and dining out was way down, as was the cost of commuting. Record high stock market values often feed into strong auto sales as well, as the wealth effect leads consumers to put aside less money for long-term savings.

And then there were the various stimulus payments from the government, which totaled thousands of dollars for many households.

Low interest rates are allowing many buyers to spend less on car payments than they would have otherwise. And the boom in home refinancing in the last year reduced mortgage payments for millions, sometimes by enough to fit a car payment into the budget where it might not have before.

A shift away from cheaper cars

Part of what’s driving up new car prices is what consumers want to buy now. The shift from less expensive sedans to pricier SUVs and pickups was accelerating even before the pandemic.

Automakers are responding by cutting production of their less popular models to preserve the computer chips they have available for SUVs and trucks, although even those models are seeing some reduced production.

Many new car buyers are also enticed by the next generation of options.

“People can’t buy enough content when they pull the trigger on new vehicles,” said Drury. “They’re buying high trim levels and lots of options. For certain trucks, they’re paying double the sticker price for the base model, just because of the options.”

Dealers, not automakers, are the big winners

The automakers are benefiting because they don’t have to offer much in the way of incentives. Still, the supply shortage is hurting their bottom line. Ford (F) and General Motors each expect the chip shortage will cost them more than $1 billion in profits this year.

The big winners: car dealers. That includes the thousands of privately held dealerships as well as publicly traded AutoNation (AN), which specializes in new cars, and CarMax (KMX), which focuses on used cars. AutoNation (AN) reported record first quarter earnings in April, which tripled its profits from a year ago.

“This is near perfect operating environment to be an auto dealer,” said Ali Faghri, analyst at Guggenheim Securities, who follows car retailers. “Demand is incredibly robust, you have a number of tail winds that have all converged at one time. You’re not only selling a lot of cars right now, but at record margins.”

Even with the automakers being hurt by the chip shortage, the industry has come roaring back to a level that was inconceivable a year ago.

“If I had told you 12 months ago we’d be in this situation, with record vehicle sales and prices, you never would have believed me,” said Faghri. “It’s played out a lot differently than most people expected when the pandemic first hit.”

One potential downside for the industry is that eventually prices could become prohibitively high, discouraging buyers.

The University of Michigan consumer survey found more consumers volunteering that they are worried about rising prices for homes, vehicles, and household durables than at any time in decades.

“These unfavorable perceptions of market prices reduced overall buying attitudes for vehicles and homes to their lowest point since 1982,” said Richard Curtin, the chief economist for the survey.